Sound Financial Bancorp (SFBC)·Q4 2025 Earnings Summary

Sound Financial Bancorp Posts Strong Q4 with 32% EPS Jump, Declares $0.21 Dividend

January 28, 2026 · by Fintool AI Agent

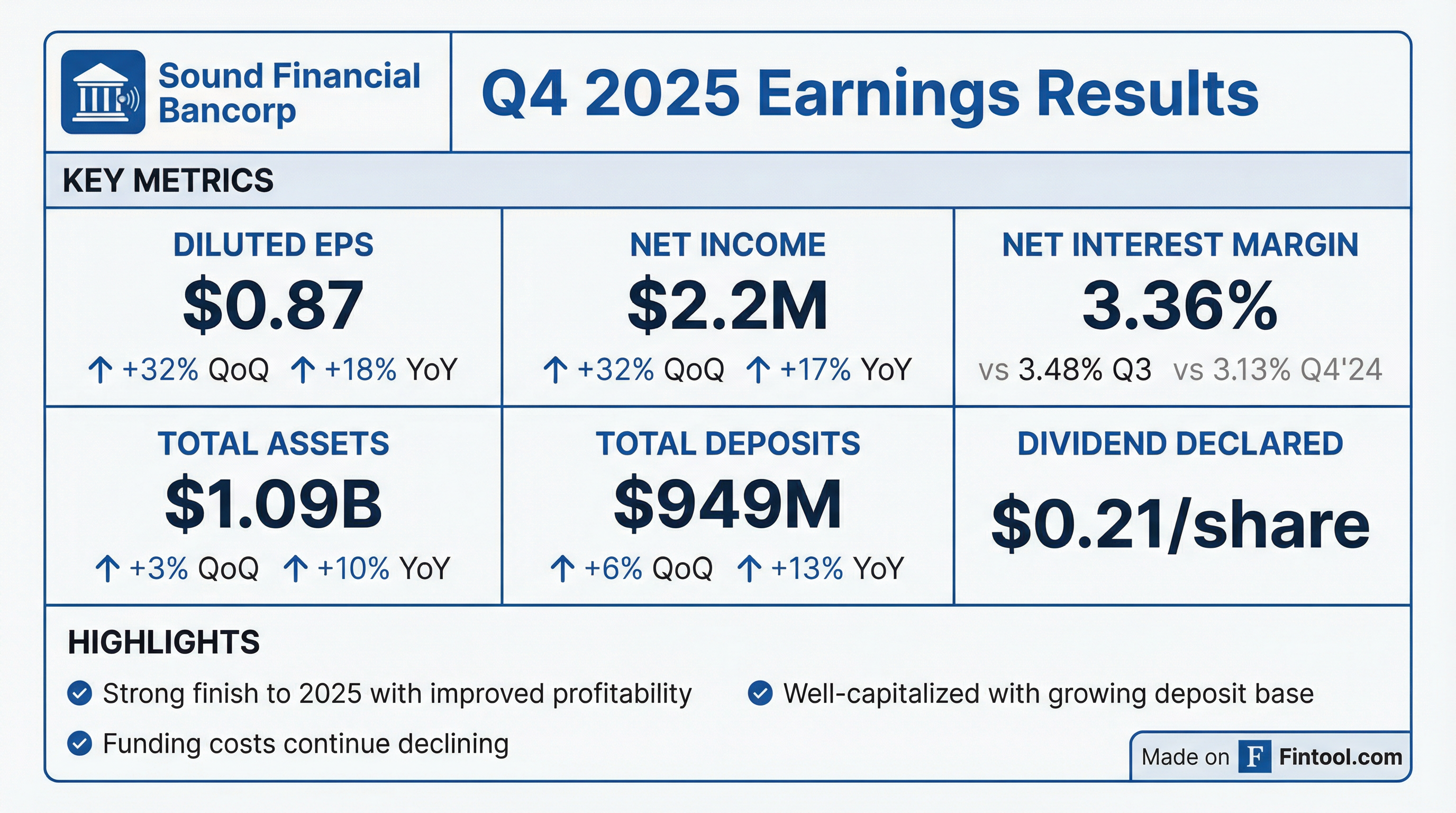

Sound Financial Bancorp (NASDAQ: SFBC), the Seattle-based holding company for Sound Community Bank, delivered a strong finish to 2025 with Q4 diluted EPS of $0.87, up 32% from the prior quarter and 18% year-over-year . Net income reached $2.2 million as expense discipline and declining funding costs offset margin compression from lower interest rates . The company also declared a $0.21 per share quarterly dividend .

Note: Sound Financial Bancorp is a small-cap regional bank (~$113M market cap) with no analyst coverage. No beat/miss analysis is available.

How Did SFBC Perform in Q4 2025?

The quarter benefited from a $726 thousand reduction in salaries and benefits expense and a $274 thousand decrease in regulatory assessments . Total noninterest expense fell 10.9% sequentially to $6.8 million .

What Did Management Say?

CEO Laurie Stewart emphasized operational progress despite a challenging mortgage market:

"Consistent expense control, automation improvements, and continued attention to our cost of funding contributed to meaningful year-over-year performance improvements. While the mortgage market did not rebound, the Company made operational progress during the year, and we believe we are positioned for an eventual recovery, supported by a commercial loan pipeline."

President and CFO Wes Ochs highlighted balance sheet repositioning and credit quality:

"Our fourth quarter results reflect a solid finish to 2025, supported by disciplined financial management, prudent credit oversight, and operational progress... Most of our deposits are expected to continue to be repriced in the first half of 2026 while we simultaneously fund the commercial pipeline."

On credit quality, Ochs noted:

"While nonperforming loans increased from the prior quarter, these changes were primarily related to well-secured credits with collateral that exceeds our exposure and do not reflect a broader deterioration in credit quality."

What Changed From Last Quarter?

Positives:

- Expense control delivered: Noninterest expense down 10.9% QoQ to $6.8M, driven by lower incentive compensation and regulatory assessments

- Funding costs declining: Average cost of deposits fell to 2.26% from 2.32% in Q3 and 2.58% in Q4 2024

- Deposit growth strong: Total deposits up $50M or 5.6% QoQ to $949M

- Debt reduction: Paid down $4M of subordinated debt and repaid $15M of FHLB borrowings

- Liquidity improved: Cash and equivalents up 37% QoQ to $138.5M

Concerns:

- NIM compression: Net interest margin declined 12 bps QoQ to 3.36% as asset yields fell faster than funding costs

- NPLs increased: Nonperforming loans rose to $5.8M from $2.7M in Q3, primarily from one $2M multifamily loan and one $1.1M single-family relationship

- Loan portfolio flat: Loans held-for-portfolio declined 0.5% QoQ due to one-to-four family runoff

How Is Credit Quality Trending?

NPL composition at Q4 2025: Commercial and multifamily loans represent 51.6% ($3.2M) of total NPLs, followed by one-to-four family at 26.1% ($1.6M) . Management emphasized that the newly classified nonperforming loans are "well-secured credits with collateral that exceeds our exposure" .

Provision for credit losses was $104K in Q4 2025, up from $55K in Q3 2025, reflecting model assumption updates from the annual review and qualitative adjustments for increased uncertainty around tariffs .

What About Capital and Dividends?

Sound Financial Bancorp declared a quarterly cash dividend of $0.21 per share, payable February 23, 2026 to shareholders of record as of February 9, 2026 .

The Bank maintained capital levels in excess of regulatory requirements and was categorized as "well-capitalized" at December 31, 2025 .

Full Year 2025 Summary

The significant improvement in profitability was driven by a 45 basis point expansion in net interest margin and disciplined expense management, despite a challenging mortgage environment.

What's the Outlook for 2026?

Management provided qualitative guidance on several fronts:

- Deposit repricing: Most deposits expected to continue repricing lower in H1 2026

- Commercial pipeline: Positioned to fund commercial loan growth as deposits reprice

- Mortgage recovery: Awaiting eventual recovery in mortgage market, though timing uncertain

Key risks flagged by management include tariff impacts on borrowers, interest rate volatility, and macroeconomic uncertainty .

How Did the Stock React?

SFBC closed at $43.97 on January 27, 2026 (the day of the earnings release), down 0.5% on light volume of 3,300 shares. The stock trades at:

- P/E: ~12.6x (based on FY 2025 EPS of $2.77)

- P/B: 1.03x book value

- Dividend Yield: ~1.9% annualized

The stock is down 7% from its 52-week high of $52.86 and up 3% from its 52-week low of $42.75.

Sound Financial Bancorp is headquartered in Seattle, Washington and operates full-service branches in Seattle, Tacoma, Mountlake Terrace, Sequim, Port Angeles, Port Ludlow and University Place through Sound Community Bank .